How an ILIT and Crummey Protocols Can Be an Estate Plan Cornerstone

BY: Joan Koss, MBA, CFP®, ChFC®, FSCP®, LUTCF®

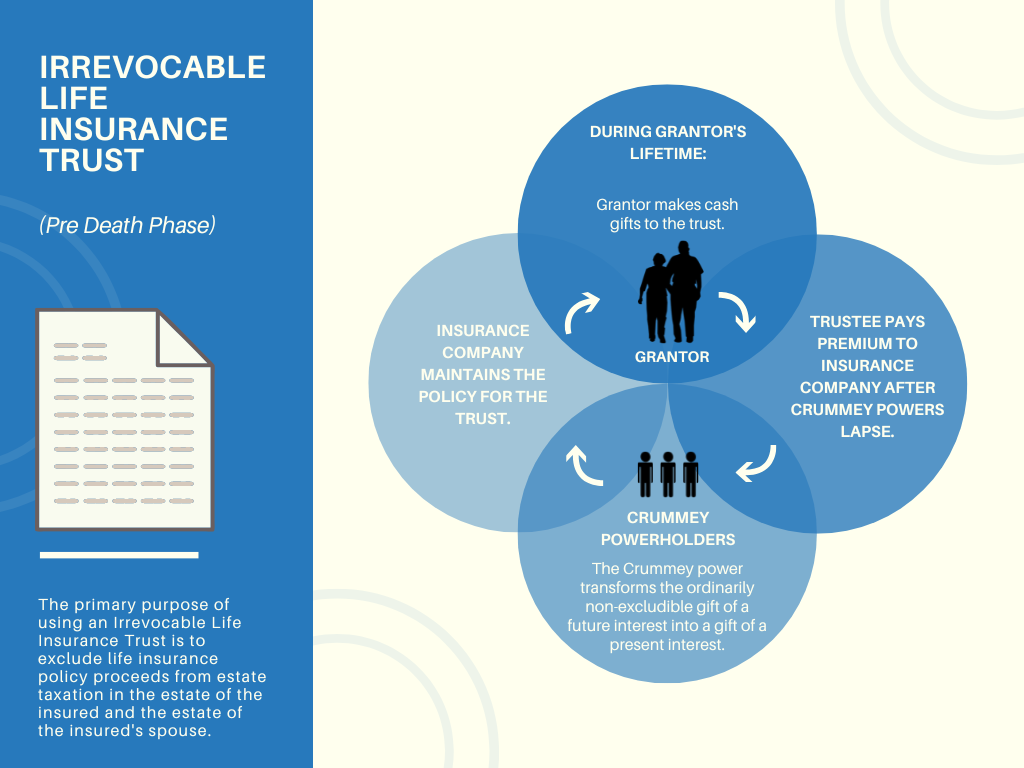

At its core, an irrevocable life insurance trust (ILIT) allows individuals to transfer ownership of their life insurance policies to a trust while still retaining the ability to control how the death benefit is distributed.

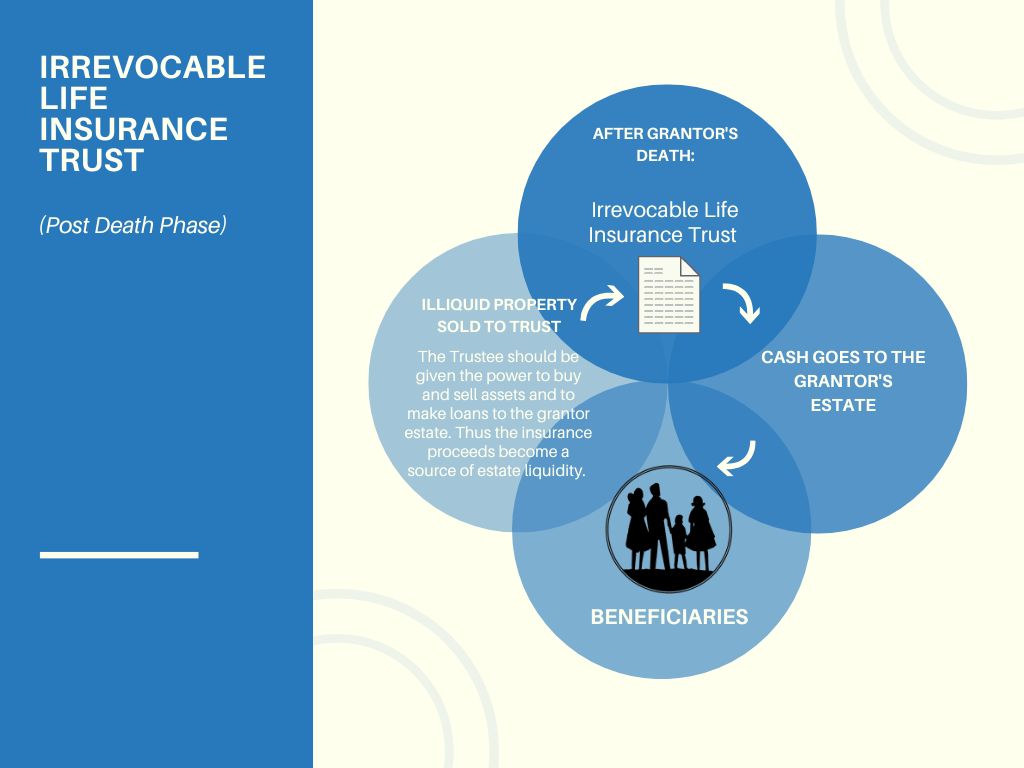

There are several benefits to using an ILIT as part of an estate plan. First, by transferring ownership of a life insurance policy to an ILIT, the policy’s death benefit is removed from the taxable estate of the individual or married couple. This can help to reduce the overall tax burden on the estate and ensure that more of the assets are available to be distributed to beneficiaries.

Second, an ILIT allows individuals to retain some control over the trust funds and have greater control over how the death benefit is distributed. The trust can be set up to distribute the funds in a way that meets clients’ specific financial and personal goals, such as providing for a spouse or children, supporting a charitable cause, and/or paying for education expenses. This can be especially useful if the individual has concerns about the financial responsibility or judgment of the beneficiaries.

Third, an ILIT can provide a measure of asset protection. If the individual or individuals own the life insurance policy outright, it may be subject to creditor claims in the event of bankruptcy or litigation. By transferring ownership to an ILIT, the policy’s death benefit is protected from such claims and can be used to provide financial security for loved ones.

How Crummey Protocols Can Enhance an ILIT’s Effectiveness

Crummey protocols can be used in conjunction with an ILIT to further enhance its effectiveness as a tool for estate planning. Under the Crummey protocols, individuals can designate certain beneficiaries, such as children or grandchildren, as “Crummey beneficiaries.”

There are several advantages to using Crummey powers to pay the premiums of an irrevocable life insurance trust. First, using Crummey powers can help to ensure that the ILIT qualifies for the gift tax exclusion. Under the Internal Revenue Code, an individual can make gifts of up to a certain amount each year without incurring gift tax ($17,000 for single and $34,000 for married filing jointly in 2023).

When an individual makes a gift to an ILIT, the gift may be subject to gift tax if the individual (or grantor) retains certain powers or interests in the trust, such as the right to receive income or to control the trust’s assets. However, by including Crummey provisions in the trust document, the individual can grant beneficiaries the right to withdraw a portion of the trust funds each year, which would qualify any contribution to the ILIT as a gift of “present interest.”

This right to withdraw must be exercised within a certain period, typically 30 days. By granting this right to withdraw, the ILIT may avoid being classified as a “grantor trust” for tax purposes, which could help to ensure that contributions to the trust qualify for the gift tax exclusion and that the death benefit remains outside of the taxable estate.

Normally, if the beneficiary understands that the ultimate benefit of the trust is for the beneficiary—such as paying for education, a home in the future, life insurance, education, or the like—the beneficiary will not exercise the right of withdrawal, and the money stays in the trust. Further, should the beneficiary be foolish enough to pull the money out, the settlor of the trust can always refuse to make contributions in the future.

The process is usually an annual written notice to the beneficiary describing the right to withdraw the amount and indicating the time limit for that withdrawal. Usually, the beneficiary is asked to waive that right by signing the notice form and returning it. This is done annually, and the gift tax exclusion is maintained.

Finally, using Crummey powers can help to ensure that the ILIT remains properly funded. If the premiums are not paid, the life insurance policy may lapse, which could jeopardize the trust’s ability to provide the intended death benefit to the beneficiaries. By establishing set protocols, individuals can ensure that the premiums are paid, and the policy remains in force.

In summary, an ILIT can be an important part of a comprehensive estate plan, providing tax benefits, asset protection, and greater control over the distribution of the individual’s assets.

When used in conjunction with Crummey protocols, an ILIT can be an even more powerful tool, allowing the individual to retain some control over the trust funds while potentially avoiding being classified as a grantor trust for tax purposes, as well as maximizing gift tax exclusion limits.

We offer a complimentary 15-minute call to discuss your financial situation and concerns and share how we may be able to help.

This commentary reflects the personal opinions, viewpoints and analyses of the Stordahl Capital Management, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by Stordahl Capital Management, Inc. or performance returns of any Stordahl Capital Management, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.