The Week in Review: October 2, 2023

Government Shutdowns and Stock Market Performance

Government shutdowns make for good political drama. Nonessential workers are furloughed, travel plans to national parks could be interrupted, and some services are limited. A shutdown also increases investor anxiety.

But should sentiment take a beating? Historically, the short answer has been no.

According to CNN Business, shutdowns have lasted roughly a week on average. The most recent one stretched over 34 days.

While there is a disruption in some government services, the longer-term impact on the economy is almost zero.

When the shutdown ends, government workers receive backpay, and government contract work resumes.

If a shutdown has virtually no impact on the economy, it stands to reason that it would probably have little medium- and longer-term impact on stocks. As the graphic above highlights, the short-term effect has historically been minimal.

That’s not to say that we might not see some short-term volatility, as we saw last week. Some of that was likely tied to short-term traders taking a more cautious approach.

Any extended shutdown would also lead to a delay in some economic reports amid worker furloughs.

In addition, a shutdown might reduce the odds of a November rate increase as the view of the economy is muddied.

However, this eventually plays out (an agreement could limit, delay, or prevent a shutdown), and the historical data suggests that investors with a long-term view should not let short-term uncertainties affect their investment strategy.

The deadline to avoid a shutdown is October 1.

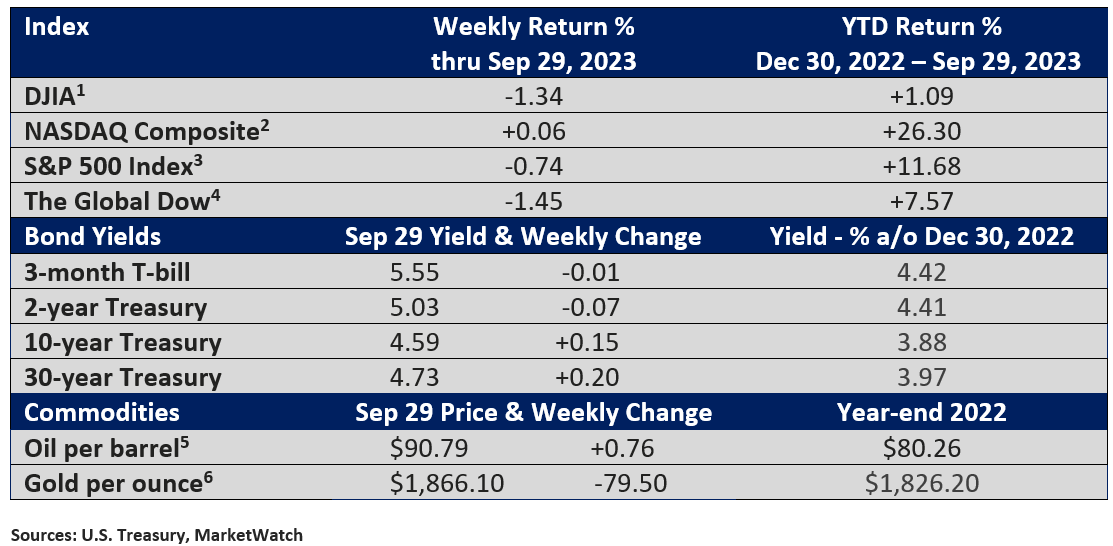

Market Summary

TWO FOR THE ROAD

From 2021 to now, investments in Artificial intelligence totaled nearly $94 billion. If AI continues this growth trajectory, it could add 1% to the U.S. GDP by 2030.-Forbes, March 31, 2023

“By the time you’re 80 years old, you’ve learned everything. Only now you have to remember it.” - George Burns

Please do not hesitate to contact me if you have any questions or concerns.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.