The Week in Review: October 9, 2023

A Hotter-for-Longer Economy

According to Dow Jones Newswires, September recorded an increase of 336,000 in payrolls, easily topping the estimate of 170,000. The unemployment rate held steady at 3.8%.

The latest economic report is signaling economic momentum, as the data has defied economists’ forecasts of a slowdown led by rising interest rates and inflation.

In part, the strong number was aided by government jobs, which rose by 73,000 last month (U.S. Bureau of Labor Statistics [BLS] data). Of that, 40,000 came from state and local education.

Education has been a big contributor to government job growth this year. But 263,000 new private sector jobs shouldn’t be overlooked. It’s a healthy number.

Some job growth may simply be tied to pandemic- and lockdown-related distortions that have not yet worked through the job market (Figure 1).

Job vacancies remain high, and some folks are still returning to the job market.

It’s not simply job growth that suggests the economy is powering ahead. Layoffs measured by the Department of Labor have recently declined, and the U.S. BLS just reported a big increase in job openings for the month of August.

For investors worried about interest rates, the higher-for-longer theme remains in play.

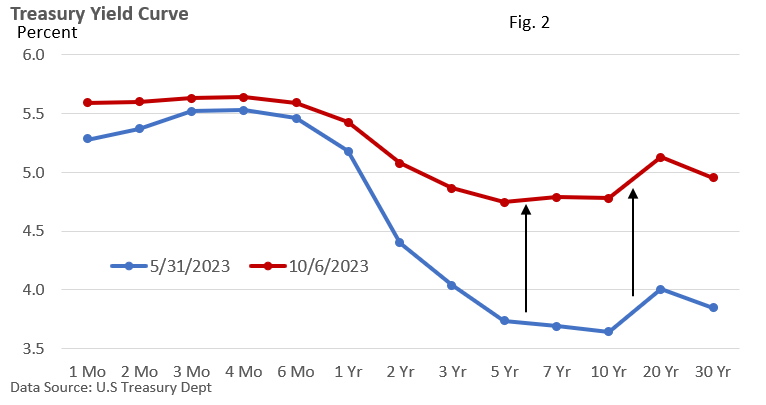

Notably, longer-term Treasury yields have jumped. Figure 2 illustrates the yield on one-month T-bills through the 30-year Treasury bond as of May 31, 2023, and October 6, 2023. Look what’s happened to longer bonds. Yields are up sharply.

It’s difficult to quantify the reason completely, but let’s review three culprits.

Investors didn’t expect a hotter-for-longer economy, and yields are repricing by going higher, i.e., the cost of money rises in response to upbeat economic growth.

Fed officials have been repeatedly insisting that the Fed funds rate will stay higher for longer (and longer and longer), which is influencing yields.

Enormous borrowing needs by the federal government increase the supply of bonds, which means higher yields are needed to attract buyers.

There is some chatter that the big increase in longer-term bond yields is doing some of the heavy lifting for the Fed, reducing the need for the Fed to hike the fed funds rate.

Ultimately, the direction of rates will largely depend on the economy's performance. Jobs data are subject to revisions. But as we’ve seen this year, the much-forecasted recession has been shy about making an appearance.

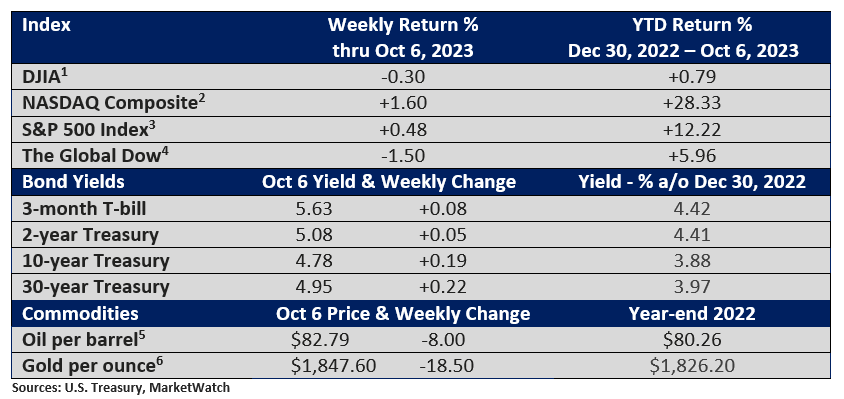

Market Summary

Please do not hesitate to contact me if you have any questions or concerns.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.