Our Take on Direct Indexing—Part 1: What Is Direct Indexing?

As if we didn’t already have enough investment strategies to choose from, a (sort of) new one has been receiving extra attention lately: direct indexing. If you’ve read about it, you may be wondering what it is, how it works, and whether it’s worth using for your own investments.

Before you decide to jump on this or any other investment bandwagon, we recommend weighing the advantages and disadvantages involved. Once you do, you are likely to find other, preferred ways to invest toward your personal financial goals.

But first things first …

What Is Direct Index Investing?

Direct index investing shares some traits with its more familiar cousin, index fund investing. A traditional index mutual fund or exchange-traded fund (ETF) buys and holds the securities tracked by a particular index, which in turn seeks to replicate the performance of a particular slice of the market.[1] For example, the Vanguard S&P 500 ETF (VOO) tracks the S&P 500 Index, which approximately tracks the asset class of U.S. large-company stocks.

In direct indexing, you invest directly in most or all of the securities tracked by an index, instead of investing in an index fund that invests in them for you.

How Does It Work?

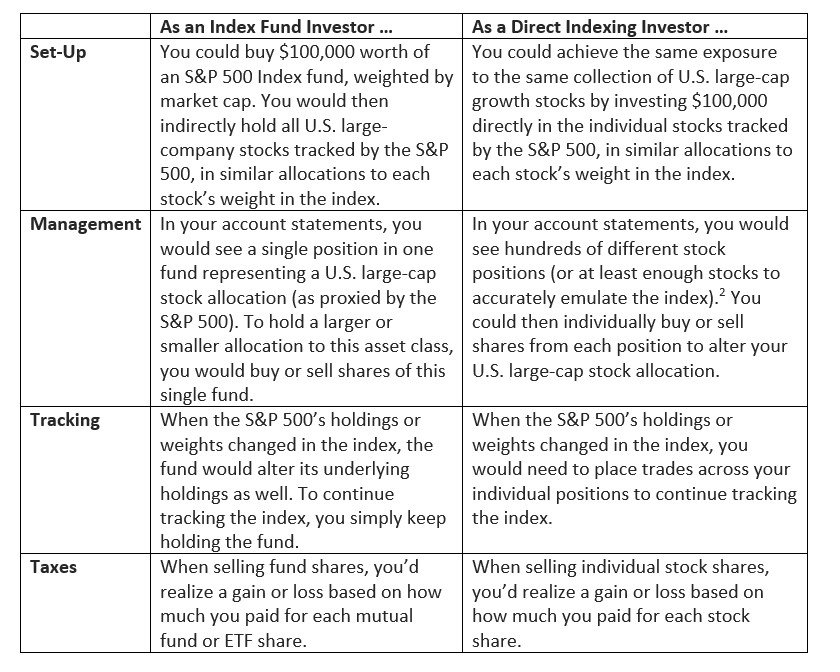

Let’s say you have $100,000 you’d like to allocate to the asset class of U.S. large-company stocks, as proxied by the S&P 500. Here’s how you or your investment manager might proceed:

Direct indexing doesn’t have to be an “all or nothing” strategy. It’s more typical to implement it for the portion of the portfolio allocated to highly liquid asset classes, such as U.S. large-cap stocks, where it’s easier to routinely buy and sell components. Direct indexing becomes increasingly impractical in markets where trading is more difficult and/or expensive.

Why Now?

Some institutional and similar large investors have been incorporating direct indexing into their portfolio builds for years, usually through separately managed accounts (SMAs). As such, the approach is not new, but it has been receiving increased media coverage lately.

That’s likely because direct indexing has become more practical for individual investors. Recently, many trading platforms have (1) eliminated investor trading fees that made it cost-prohibitive to buy and sell so many individual securities; and (2) allowed fractional share purchases, making it possible to capture an index’s holdings in smaller slices. As a result, more providers are offering direct indexing services to smaller accounts for relatively modest fees.

Why Do It?

Even if it’s possible to engage in direct indexing at costs approaching those of traditional index fund fees, why not simply go along for the low-cost index fund ride? The potentials are two-fold:

More flexible tax management: If you invest in index mutual funds or ETFs, you can only incur gains/losses on the fund’s share price. With direct indexing, you can trade on each underlying security you hold. For your taxable accounts, direct indexing thus offers more flexibility to manage when and how to incur taxable gains and losses, with an eye toward reducing your lifetime tax liabilities.

More personalized experience: Direct indexing also offers more flexibility to start with a popular index and add exceptions based on your personal financial goals. For example, you could use direct indexing to augment a regular indexing approach with a personalized values-based filter (such as adjusting your mix of “virtuous” vs. “sin” stocks). Or if you’re employed in a hot sector such as technology, you might reduce some of your exposure to that sector to offset the concentrated risks you’re already incurring through your career.

Is It Worth It?

Direct indexing may offer more granular portfolio and tax management than you can get through traditional index fund investing. But any incremental benefits must be weighed against the tradeoffs involved in implementing them. We also must determine not only whether direct indexing may be an acceptable solution, but whether it’s the best one available.

On both counts, we’re not as enthused by direct indexing as we are by our current funds-based approach to helping investors achieve their long-term financial goals.

Our concerns can be captured in a word: stamina. Your ideal investment portfolio not only must start strong but also must be built to last. In our next piece, we’ll take a closer look at why we’re not yet convinced direct indexing is the best solution for that challenge.

[1] As index investing has proliferated, so have more exotic indexes, tracking trends such as fine wine or Canadian cannabis. For our purposes, we are referring to traditional indexes, tracking broadly recognized market asset classes.

[2] One proponent of direct indexing suggests: “[Y]ou can capture the vast majority of diversification benefits of the S&P 500 by owning the largest 100 stocks in the S&P 500 Index.”

This commentary reflects the personal opinions, viewpoints and analyses of the Stordahl Capital Management, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by Stordahl Capital Management, Inc. or performance returns of any Stordahl Capital Management, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.1The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results. 2 The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results. 3 The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results. 4 The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results. 5 CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results. 6 CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.