SCM's Deep Dive: Trade Wars and Market Risk

Trade headlines continue to weigh on markets as new tariffs go into effect. President Trump recently confirmed tariffs on Canada, Mexico and China, dashing hopes of more extensions or last-minute deals. Additional tariffs are expected in the coming months, including reciprocal ones against countries that impose duties on U.S. goods.

Investors worry that a trade war could raise prices for consumers and businesses, slowing economic growth. As a result, the stock market has pulled back in recent days across major indices and sectors.

Why tariffs are a concern for the market

While market swings are never pleasant, it’s times like these that personalized, well-constructed portfolios and financial plans truly shine.

Just as markets pulled back on trade war concerns in 2017 and 2018, investors have been on edge since the presidential inauguration. History shows that markets can overcome these concerns in the long run, even if the day-to-day swings are uncomfortable.

Tariffs can be concerning because they represent taxes on imported goods that can then be passed on to buyers. With inflation rates still hotter than many would like, tariffs could add further pressure to the prices of everyday necessities. This is made worse if other countries retaliate with their own tariffs, sparking an escalating trade war.

The accompanying chart shows that the U.S. has a significant trade deficit with many major trading partners.

It’s important to keep this round of tariffs in perspective.

First, the U.S. has a long history of using tariffs dating back to the Industrial Revolution and hitting a peak during the Great Depression. The goal of tariffs is often to protect domestic industries, especially when they involve important or sensitive sectors, such as technology and national security.

Second, the previous round of tariffs during President Trump’s first administration led to trade deals with Mexico, China, and others. For the administration, tariffs are often used as a negotiating tactic for other policy objectives, such as curbing unauthorized immigration or imports of illegal drugs.

Third, market reactions to tariff announcements often prove more dramatic than their actual economic impact.

This is especially true if tariffs are short-lived or if deals are reached. While markets were choppy from 2017 to 2019 when trade wars were a concern, markets generally performed quite well.

While today’s trade war concerns differ in some ways from previous episodes, they are a reminder that market fears don’t always translate into reality.

Market pullbacks are a normal part of investing

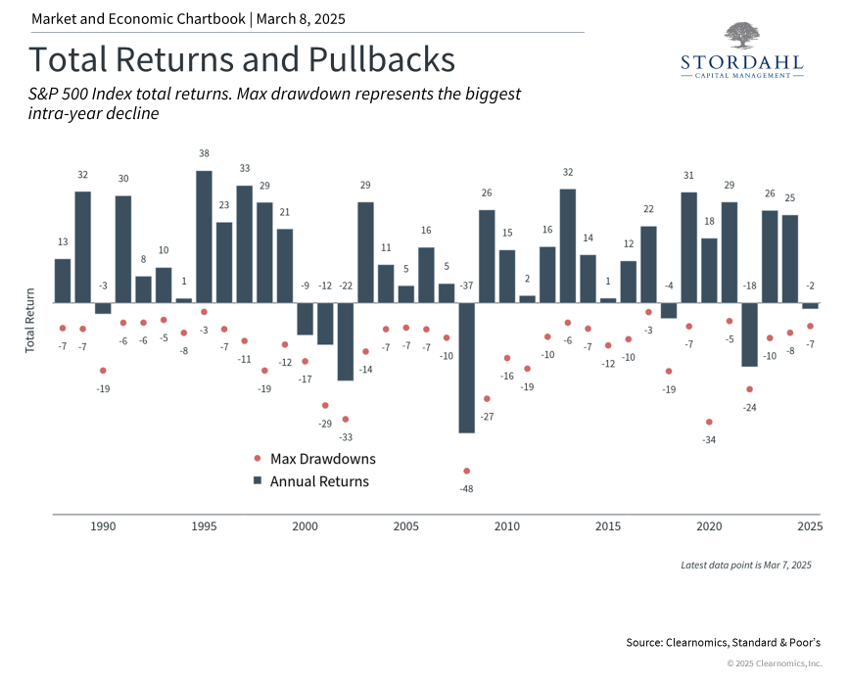

Given the market’s recent swings and the constant news coverage, the S&P 500 has pulled back about 5% at the time of this writing.

While this can be unpleasant, the reality is that market pullbacks of this magnitude occur on a regular basis. Pullbacks of this size or worse occurred twice in 2024, three times in 2023, and a dozen times during the 2022 bear market.

With markets reaching new all-time highs over the past few years, some investors may have grown accustomed to markets only moving in one direction. While the current year-to-date performance may not be what many hoped for at the beginning of the year, when much of the focus was pro-growth policies, many aspects of the market remain positive.

For example, corporate earnings grew at a strong pace this past earnings season. Unemployment is still historically low at 4.0%, wages are rising, and productivity growth remains steady. From a risk perspective, high yield credit spreads remain well below pre-pandemic levels.

This suggests bond investors are less nervous about growth prospects than the stock market.

Staying invested is the best way to weather market volatility over time.

While technology stocks have struggled, other sectors have performed well over the past several months. Other asset classes and regions have also performed well, reminding investors of the importance of a balanced portfolio. Bonds, for instance, have benefited as interest rates have fallen. As they often do in difficult market environments, positive bond returns have helped to offset stock market declines in diversified portfolios.

History shows that maintaining a long-term approach remains one of the most effective strategies for navigating market volatility. While short-term market swings can be unsettling, investors who stay consistently invested through market cycles have historically captured the benefits of compound returns.

So, although there will be more trade headlines in the coming days, it’s important to remember that investing is not about a single day, week, or month. Instead, building and holding a well-constructed portfolio is about achieving financial goals over years and decades.

The bottom line? Trade-related uncertainties have led to a pullback in major indices. History suggests that maintaining a long-term perspective, rather than reacting to daily market moves, is the best way to achieve financial success.

If you want to discuss this further, we offer a complimentary 15-minute call to discuss your concerns and share how we can help.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.