The ABCs of Behavioral Biases Conclusion

We’ll wrap the ABCs of Behavioral Biases by repeating our initial premise: Your own behavioral biases are often the greatest threat to your financial well-being. We hope we’ve demonstrated the many ways this single statement can play out, and how often our survival-mode brains trick us into making financial calls that foil our own best interests.

But don’t take our word for it. Just as we turn to robust academic evidence to guide our disciplined investment strategy, so too do we turn to the work of behavioral finance scholars, to understand and employ effective defenses against your most aggressive behavioral biases.

If there hadn’t been so much damage done, behavioral finance might have been of merely academic interest. But given how often, and in how many ways your fight-or-flight instincts collide with your rational investment plans, it’s worth being aware of the tell-tale signs. That way, you may be able to detect when a behavioral bias is running roughshod over your higher reasoning.

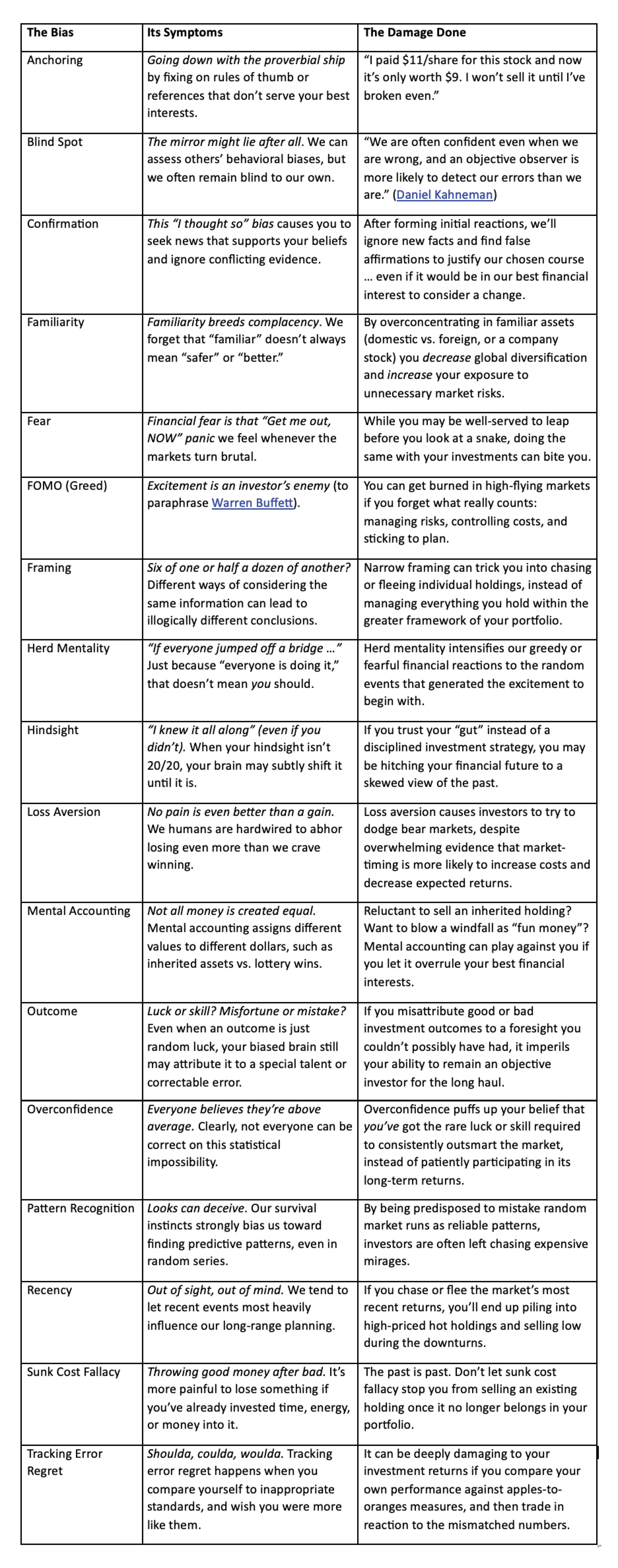

To help with that, here is a summary of the biases we’ve covered throughout this series:

A Behavioral Bias Overview

Next Steps: Think Slow

Even once you’re familiar with the behavioral biases that stand between you and clear-heading thinking, you’ll probably still be routinely tempted to react to your fear, greed, doubt, excitement, and similar hot emotions.

The late Nobel laureate Daniel Kahneman helps us understand why in “Thinking, Fast and Slow,” where he describes how we engage in System 1 (fast) and System 2 (slow) thinking: “In the picture that emerges from recent research, the intuitive System 1 is more influential than your experience tells you, and it is the secret author of many of the choices and judgments you make.”

In other words, for better or worse, in life and investing, our reflexes rather than our reflections often run the show.

This is one reason an objective advisor can be such a critical ally, helping you move past your System 1 thinking into more deliberate decision-making for your long-term goals. On the flip side, financial providers who are themselves fixated on picking hot stocks or timing the market on your behalf are more likely to exacerbate than alleviate your worst biases.

Investors of “Ordinary Intelligence”

Berkshire Hathaway Chairman and CEO Warren Buffett is a businessman, not a behavioral economist. But he does have a way with words. We’ll wrap with a bit of his timeless wisdom:

“Success in investing doesn’t correlate with I.Q. once you’re above the level of 25.

Once you have ordinary intelligence, what you need is the temperament to control the

urges that get other people into trouble in investing.”

If you can remember this cool-headed thinking the next time you’re tempted to act on your investment instincts, Mr. Buffett’s got nothing on you (except perhaps a few billion dollars). Still, for help managing the behavioral biases that are likely lurking in your blind spot, give us a call. In combatting that which you cannot see, two views are better than one.

If you want to discuss this or anything else that is on your mind, we offer a complimentary 15-minute call to discuss your concerns and share how we can help.

This information should not be construed as investment, tax, or legal advice. This commentary reflects the personal opinions, viewpoints, and analyses of the Stordahl Capital Management, Inc. employees providing such comments and should not be regarded as a description of advisory services provided by Stordahl Capital Management, Inc. or performance returns of any Stordahl Capital Management Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.