The Week in Review: April 10, 2023

Hiccups in the Job Market

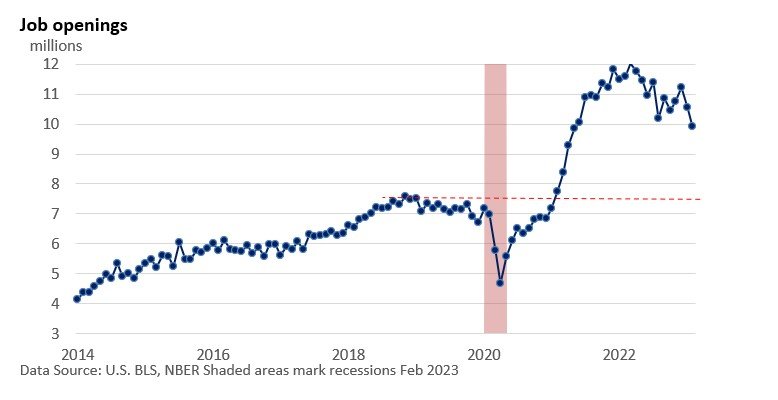

Last week the U.S. Bureau of Labor Statistics reported that job openings fell 632,000 in February to 9.93 million. That’s on top of a downwardly revised 670,000 in January.

Openings remain historically high, though they have been moving lower. This is Fed-friendly because the Fed wants to slow inflation by bringing the demand for labor back in line with the supply of labor.

However, its tools are blunt and can’t be targeted toward specific industries.

While there are plenty of companies begging for workers, there is a mismatch in skills. Openings remain very high for restaurants and other lower-paying service jobs, while tech and other large firms are being much more selective.

Deciphering the data

The recent revisions in job openings also highlight the problems we sometimes see with the data. Distortions in spending created by the pandemic aren’t yet fully understood or incorporated into models.

Data models are seasonally adjusted so we can compare weekly, monthly, and quarterly reports as if they are apple-to-apple comparisons.

For example, spending typically jumps in November and December and falls sharply in January. That’s before the data models are adjusted for seasonal variations.

However, the pandemic forced a shift in patterns. Holiday spending has spilled into October. That means actual spending doesn’t go up as much in December as it did in the past. So, spending in December fell last year after seasonal adjustments.

Continuing, actual spending didn’t fall as much in January. Coupled with milder weather in much of the country, spending with seasonal adjustments surged in January per Census data.

What does it mean? As we entered 2023, the economy wasn’t as robust as some of the earlier reports suggested, and recent data are signaling a slowdown, including the labor market.

Please let me know if you have questions or would like to discuss any other matters.

Two for the Road

Data from Cigna reveals that the doctors they keep on staff to approve or deny claims are really, really fast at denying claims. One medical doctor declined 60,000 claims in a single month. Over the course of just two months, Cigna doctors declined 300,000 requests without even glancing at a file, spending an average of just 1.2 seconds per case. -ProPublica, March 25, 2023

A blended study of 105,000 headlines and 370 million impressions concluded that “each additional negative word” in a news headline increased the click-through rate by 2.3%. - Nature Human Behavior, March 16, 2023

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.