The Week in Review: April 3, 2023

Inflation—It Hasn’t Gone Away

Inflation was uppermost on the minds of investors, Fed officials, and policymakers until the failure of Silicon Valley Bank (SVB) forced price stability to play second fiddle to banking stability.

The banking crisis has eased amid tentative signs that actions taken by the U.S. Treasury, the FDIC, and the Federal Reserve are having their intended effect: preventing contagion.

While the impact of SVB’s failure on U.S. economic activity is uncertain, inflation has yet to go into hibernation.

Unlike the better-known Consumer Price Index, the PCE Price Index is not a household name. But it’s like the CPI, and it’s the Fed-favored gauge for measuring inflation.

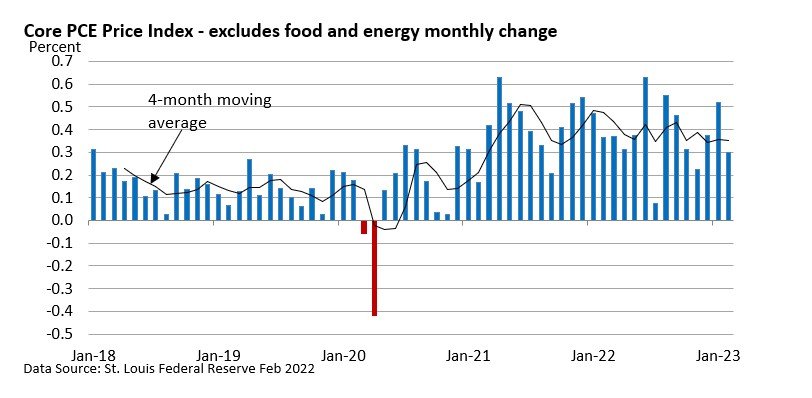

The graphic below highlights the monthly change in the core PCE Price Index. The core excludes food and energy prices.

The 0.3% rise in February is encouraging, but inflation remains above the Fed’s 2% annual goal.

The headline PCE Price Index in February is up 5.0% versus one year ago, slowing from 5.3% in January. The Core PCE Price Index is up 4.6% vs 4.7% in January.

The four-month average, which smooths away monthly volatility and seasonal quirks that may pop up in the data, suggests progress on the pricing front remains slow.

While anxieties over the banks have eased, it’s unknown how March’s banking tremors will ripple through the economy.

If banks raise the bar for who might get loans, the banking crisis does the Fed’s job for it. Economic growth slows, and inflation would probably ease, too. But the economy could slide into a recession.

For investors, the Fed’s reaction will depend on how the banking system stabilizes (and initial signs are cautiously positive), incoming data on inflation, and the general economy.

Please let me know if you have questions in today’s uncertain environment. We’re simply an email or phone call away.

Two for the Road

U.S. companies reshored, or returned to the U.S., 364,000 jobs from overseas last year. - The Wall Street Journal, March 23, 2023

An Illinois man has filed a class-action lawsuit against Buffalo Wild Wings because its so-called “Boneless Wings” are breast meat, not wings. Airmen Halim’s suit seeks punitive damages for what he calls a “clear-cut case of false advertising.” The restaurant chain mocked Halim’s complaint, noting in a tweet that “our buffalo wings are 0% buffalo.”- NPR, March 15, 2023

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.