The Week in Review: August 14, 2023

Lessons from the 1960s

Fed Chief Jay Powell and other Fed officials have been open about discussing the lessons they learned and the errors made during the 1970s.

The Consumer Price Index (CPI) jumped to an annual rate of over 12% in 1974 before falling back to 5% by 1976, per St. Louis Federal Reserve data.

However, the Fed became complacent and was forced to chase a rising inflation rate, with the CPI hitting nearly 15% by 1980.

But what about the lessons of the 1960s? And how might they relate to our current situation?

Let’s start with last week’s report. The CPI and the core CPI, excluding food and energy, rose 0.2% in July, according to the U.S. Bureau of Labor Statistics.

It is encouraging to note that before rounding up, the monthly core rate increased by just 0.16% in June and July.

On an annual basis, the CPI increased 3.2% in July, up from 3.0% in June, while the core rate slowed from 4.8% to 4.7%. Both are still too high but are moving in the right direction.

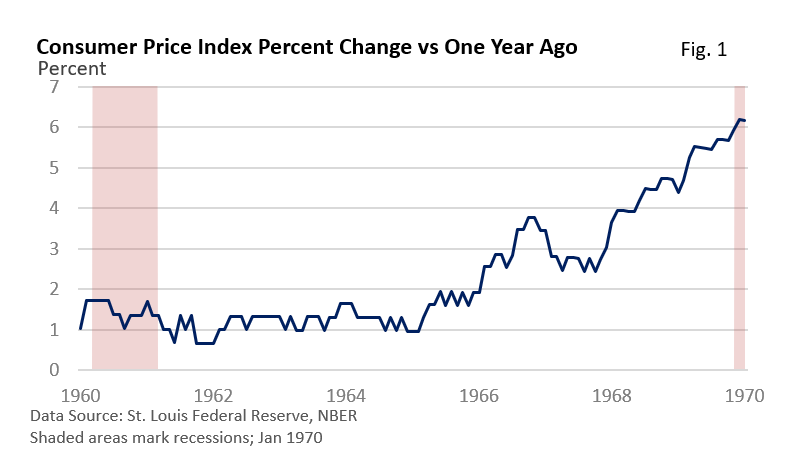

Back to our original question—what about the lessons of the 1960s? The rate of inflation doubled between early and late 1966. However, the CPI slowed significantly in 1967, which we’re seeing today—see Figure 1.

Why did the rate briefly slow in the 1960s? The Fed engineered the perfect soft landing—a slowdown in economic growth, a stable jobless rate, and the avoidance of a recession.

Among other things, it was a triumph for monetary policy and the Fed.

However, the victory over inflation proved to be temporary, as prices resumed their upward march in the late 1960s.

While there are some similarities between the 1960s and the present day, it's also important to recognize the differences. Besides, we don’t want to downplay recent progress on inflation.

But a repeat of the 1960s is best avoided.

Market Summary

TWO FOR THE ROAD

There are now more NBA players with $30 million annual salaries than CEOs of S&P 500 companies who are guaranteed that much. - Wall Street Journal, July 14, 2023

Virgin Galactic has taken a former Olympian, a University of Aberdeen student, and her mother to the edge of space on its first flight for tourists. Ana Mayers, 18, and her mother Keisha Schahaff, 46, both from Antigua, won their tickets in a competition. They became the first mother-daughter duo to fly to space together. Jon Goodwin, from Newcastle-under-Lyme, became the second person with Parkinson's disease to go to space, a trip he called "completely surreal". Mr. Goodwin bought his ticket for $250,000 (then £191,000) in 2005. The carrier mothership VMS Eve took off from Spaceport America, in the state of New Mexico, at 08:30 local time (15:30 BST). They successfully landed back at Spaceport America just over an hour after taking off. "I'm hoping that I instill in other people around the world, as well as people with Parkinson's, that it doesn't stop you doing things that's out of the normal if you've got some illness," he said. – BBC News 8/10/2023

Please do not hesitate to contact me if you have any questions or concerns.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.