The Week in Review: August 21, 2023

Treasury Yields Drift Higher

Recession talk earlier this year and a belief that the Federal Reserve was nearly finished hiking interest rates kept a lid on longer-term Treasury yields. That’s changed.

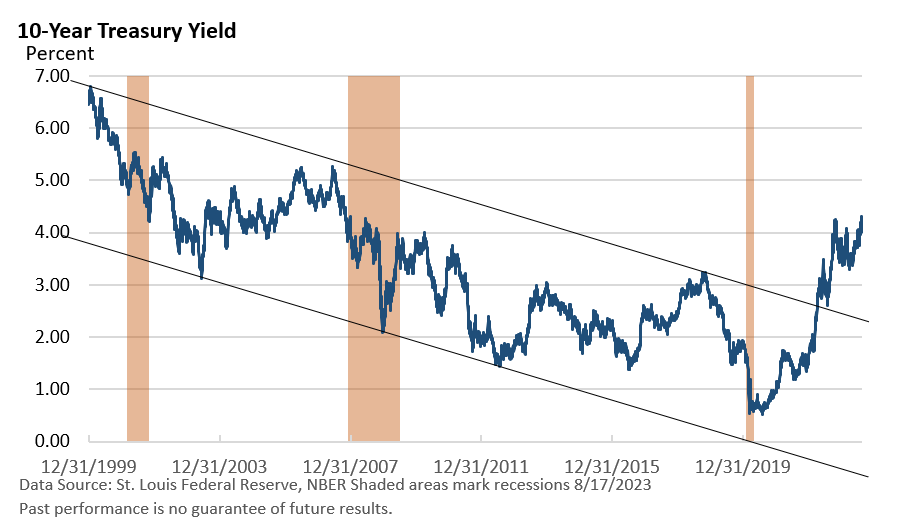

Last Thursday, the 10-year Treasury yield closed at 4.30%, according to the U.S. Treasury. It was the highest close since late 2007 (St. Louis Federal Reserve Treasury data).

As the graphic illustrates, the long-term trend has shifted. But why have yields recently lurched higher?

To begin with, the Treasury Department is ramping up debt issuance. In late July, the Treasury revised its net borrowing estimate for the third quarter to $1 trillion, significantly higher than the $733 billion projected in early May, according to Bloomberg News.

Meanwhile, the Federal Reserve has not only stopped buying long-term Treasury bonds, but it is also letting some of its long-term Treasuries roll off its balance sheet when the bonds mature rather than replacing them.

In other words, all else equal, a greater supply of bonds and fewer buyers puts downward pressure on Treasury bond prices (bonds and yields move in the opposite direction).

Next, economic growth jumped in July, contrary to what most analysts had expected. It’s early in the quarter, but the Atlanta Fed’s GDPNow model, which estimates GDP growth throughout the quarter, tracks Q3 GDP at an astounding 5.8% annualized pace (as of August 16).

Even if the model is one or two percentage points too high, 3.8 – 4.8% growth is still impressive.

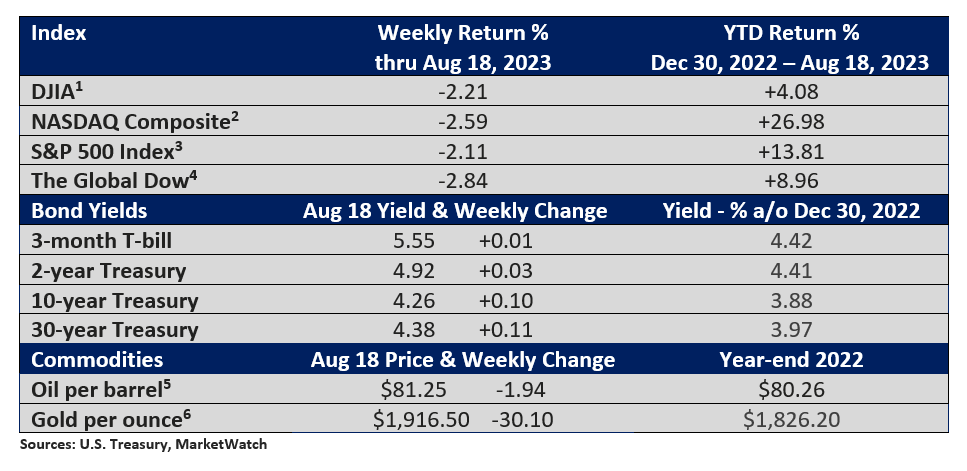

Market Summary

Faster growth may not only put upward pressure on inflation, it may also encourage the Federal Reserve to accelerate the pace of rate hikes. If not, the bond market may try to do the Fed’s job for it, driving yields higher.

Of course, that’s not a foregone conclusion. Economic data can be lumpy—fast one month and slower the next.

To some extent, however, the rise in yields has encouraged a modest pullback in stocks.

TWO FOR THE ROAD

Almost $10 trillion has been restored to equity valuations in the past nine months. Up 27% from its October trough, the S&P 500 is now about 5% away from reclaiming its all-time high of 4,796.56 reached in January 2022. - Fortune, July 22, 2023

Additional fees have been around for a long time, but they are cropping up everywhere these days. It is estimated that Americans now spend more than $65 billion on “junk fees” every year. -NPR, July 27, 2023

Please do not hesitate to contact me if you have any questions or concerns.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.