The Week in Review: August 5, 2024

A September Rate Cut is on the Table, Softer Economic Data Raises Worries

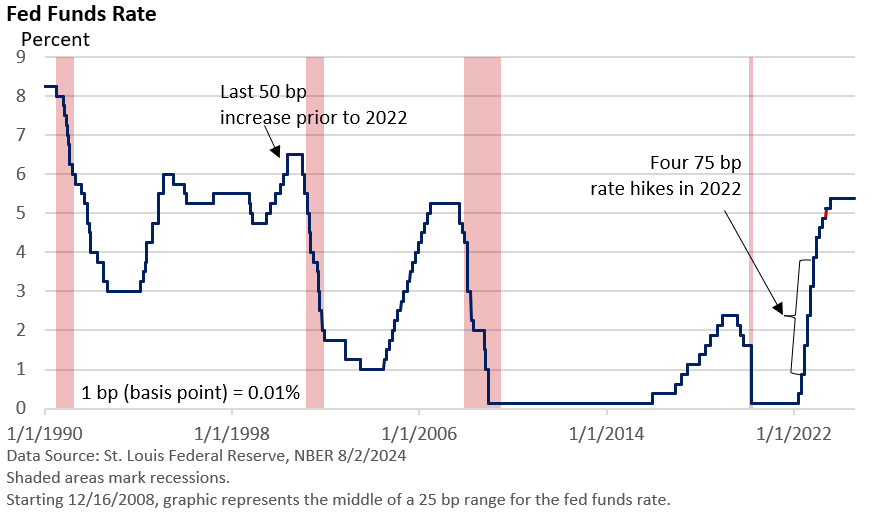

As expected, the Federal Reserve kept its key rate, the fed funds rate, unchanged at 5.25 – 5.50%. After holding the fed funds rate steady for a year, Fed Chief Jay Powell twice mentioned that a September rate cut is on the table at his press conference

The Federal Reserve is shifting its focus from singularly fighting inflation by acknowledging the softening job market and stressing that maintaining full employment remains an important goal.

As reported Friday, nonfarm payrolls grew by a softer-than-expected 114,000 in July, according to the U.S. Bureau of Labor Statistics (BLS).

Private-sector payrolls grew by 97,000, including 64,000 in health care and social assistance—just 33,000 for the remainder of the private sector.

While price increases remain above the Fed’s target, monetary policy has helped rein in inflation. As the inflation rate has slowed, labor market metrics have come into balance.

However, the pendulum swings slowly, and the Fed is becoming increasingly sensitive to the risk that the pendulum might swing too far, i.e., a surplus in labor that could exceed labor demand.

You see, the Fed can’t fine-tune the labor market. For that matter, no one can. The labor market is much more balanced today than two years ago, as higher rates have helped significantly lower job openings. But layoffs haven’t been completely avoided, and the unemployment rate is rising.

The jobless rate rose to 4.3% in July from June’s 4.1%. In any other cycle, a 0.9 percentage point rise from its cyclical low of 3.4% would signal that a recession has already begun.

In today’s environment, a rise from January’s 3.7% jobless rate to 4.3% in July has been accompanied by a 1.4 million rise in nonfarm payrolls during the same period, per the U.S. BLS. The two data points are derived in part from two separate surveys.

Bad news is bad news

Bad economic news quickly became bad news for investors. Previously, softer economic news was seen as an encouragement for the Fed to cut rates.

Today, rate cuts are priced in, but a sharp economic slowdown or recession isn’t. Consequently, stocks and Treasury yields fell over the last couple of days, as investors priced in new data.

Stocks are up sharply this year, and volatility can never be ruled out. Stocks trend upward in the long run, and temporary declines are to be expected. A well-diversified financial plan takes volatility into account.

That said, most economic indicators aren’t signaling an immediate recession. Last week’s Q2 GDP report suggested the economy entered Q3 with some momentum.

We may be simply seeing seasonal quirks overstating a slow labor market. It’s possible that US BLS data exaggerated job growth earlier in the year, and we’re seeing some giveback today. August’s report will be revised in September and October.

Be that as it may, the just-concluded Fed meeting and a cooler labor market strongly suggest we’ll see a rate cut at the September meeting. It’s a major reason why Treasury bond prices rallied last week (bond prices and yields move in the opposite direction).

Market Summary

Two for the Road

At the end of the first quarter of 2024, Americans were holding a record $2.4 trillion worth of U.S. Treasurys. - MarketWatch, July 17, 2024

U.S. stocks have outperformed international stocks for 16 years running and by a huge margin. The result: we are now 3 standard deviations above the mean in terms of historical U.S. outperformance, a record high. - Charlie Bilello, June 23, 2024

Please do not hesitate to contact me with any questions or concerns. I hope you have a wonderful week!

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.