The Week in Review: December 20, 2021

Powell Pivots

The Federal Reserve and Fed Chief Jerome Powell are finally coming to grips with the idea that inflation may be a bigger problem than they initially expected. Out is the word “transitory” to describe surging prices. It is the idea that the Fed must take a stronger approach.

On Wednesday, the Fed announced it will reduce the amount of bonds it buys by $30 billion per month starting in January, double the pace it announced at its November meeting.

At the current pace, bond buys will end in March rather than June, possibly teeing up the first rate in May, or perhaps March, as one Fed official said, according to the Financial Times.

Ending the purchases earlier gives the Fed more flexibility to raise interest rates sooner.

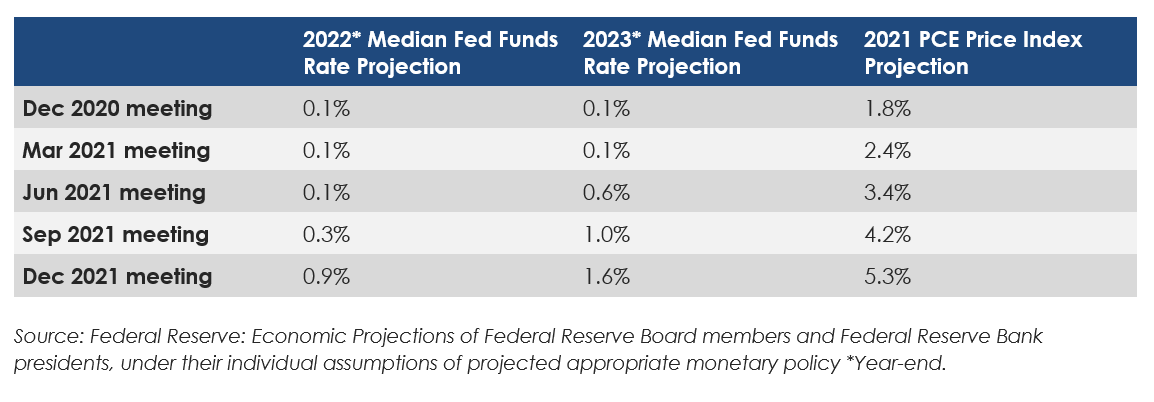

The Fed’s Economic Projections suggest as much. In 2022, the Fed projects three 0.25-percentage-point rate hikes, versus just one at the September meeting. That would place the fed funds rate at 0.75-1.0% versus today’s range of 0.0-0.25%.

Powell’s comments during his Wednesday press conference were an attempt, at least in part, to reassure investors and not rattle markets. It was not as aggressive as some had expected. The $30 billion taper and forecast of three rate hikes next year were generally in line with expectations.

Still, emergency stimulus introduced at the beginning of the pandemic continues. Given the jump in inflation, the Fed could have acted more aggressively. It didn’t.

Or it could have acted sooner. It hasn’t.

When asked if he believes the Fed is behind the curve on inflation, Powell responded, “The risk of higher inflation becoming entrenched has increased,” (but) “I don't think it's high at this moment, but I think it's increased.”

Maybe it’s not entrenched, but the Fed’s credibility on inflation has come into question after repeatedly emphasizing that it expected the initial burst to be temporary. Note the Fed had projected 1.8% inflation as 2021 was about to begin—table above.

A fear in some corners is that this year’s supply chain hiccups, which have influenced inflation, might be replaced next year by a wage-price spiral. In other words, labor shortages and higher prices lead to higher wages, which force businesses to pass along the higher costs.

Today, Fed officials don’t see that. Just the opposite, they expect inflation to slow significantly next year. But the big miss in 2021 has undermined their credibility.

Over the near term, investors are digesting the less dovish stance and balancing it with the prospect that profit growth will remain strong.

If you have any questions or would like to discuss any other matters, please let me know.

Two for the Road

Before the pandemic changed the working world, Americans ranked flexibility to set their own work schedules as the 74th most important out of 76 attributes associated with a successful and happy life. Now it sits at No. 2, second only to compensation. —Axios, November 16, 2021

Founded in 1976, it took Apple 44 years to reach the $1 trillion level for the first time. Two years later, in August of 2020, the stock hit $2 trillion. And now just 15 months later, the stock is zeroing in on $3 trillion. —Barron’s, December 10, 2021

Warmest regards and best wishes for a Merry Christmas to you and your family!

This commentary reflects the personal opinions, viewpoints and analyses of the Stordahl Capital Management, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by Stordahl Capital Management, Inc. or performance returns of any Stordahl Capital Management, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.