The Week in Review: December 4, 2023

Pandemic Savings: How Much Remains to Fuel Economic Growth?

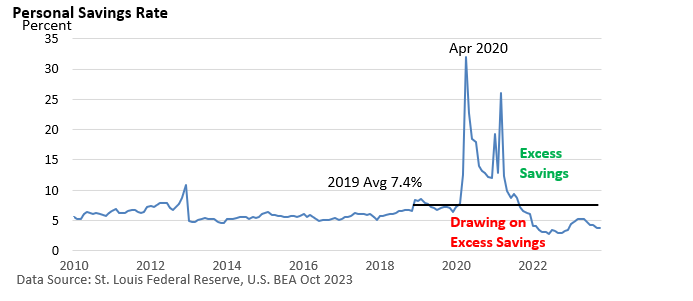

The savings rate soared during the pandemic. The government was generous with cash payments, and most of us had limited opportunities to spend.

Eventually, these payments ended while spending jumped as the economy reopened and inflation soared.

The graphic below highlights the journey. The first spike in April 2020 came amid payments from the CARES Act. The spike in January and March 2021 came amid 2 stimulus bills.

But what’s left in savings from government payments?

It’s an important question because “excess savings” have helped fuel spending and economic growth.

And that cash has helped blunt the negative impact of Fed rate hikes, playing a role in spoiling recession forecast from last year.

Using the latest data, we think there is roughly $1 trillion in cash in the hands of individuals remaining from stimulus checks, but estimates vary wildly.

The Big Question

That’s a lot of dry powder to fuel economic growth. But will any savings that may remain really boost growth?

Some folks may simply hang on to those dollars, using them as a rainy-day fund. Spending doesn’t increase, but cash is available if economic conditions deteriorate, potentially softening any blow to the economy.

If they do, there is not much more those dollars can do to fuel more economic growth.

Market Summary

Two For the road

Walmart’s physical footprint is unmatched, with enough floor space in stores in the United States alone to accommodate some 12,500 football fields. - Chartr, November 19, 2023

With an average age of 78, the Rolling Stones are hitting the road again in 2024 with a 16-city tour. It is being sponsored by AARP (seriously). - AARP, November 21, 2023

Please do not hesitate to contact me if you have any questions or concerns.

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.