The Week in Review: February 5, 2024

hold the champagne

It really shouldn’t have been a surprise. A bevy of Fed officials had already downplayed the likelihood of a March rate cut.

While Fed Chief Jay Powell didn’t slam the door shut last Wednesday, he threw cold water on the idea that central bankers were gearing up to pull the rate-cut trigger at the March meeting.

Fed officials are encouraged by the slowdown in inflation, but they are mindful that progress towards their 2% annual target could stall. Besides, economic data have largely been upbeat.

Two weeks ago, the U.S. BEA reported that Gross Domestic Product (GDP), the largest measure of goods and services, jumped at a better-than-expected annual pace of 3.3%.

On Friday, the U.S. BLS reported that nonfarm payrolls soared by 353,000 in January, well above expectations. December was revised up by more than 100,000 to 333,000. One word: strong.

Once more, the economy is demonstrating surprising resilience in the face of rising interest rates over the last couple of years.

As they seek to utilize their monetary tools to steer the economy towards a soft landing, a robust economic expansion provides the Fed with some breathing room for cutting rates.

That said, let’s review a couple of definitions that we often use: soft landing and recession.

According to Brookings, the Fed raises “interest rates just enough to slow the economy and reduce inflation without causing a recession. It has achieved what is known as a soft landing… Soft landings are the equivalent of ‘Goldilocks’ porridge.’ Following a tightening, the economy is just right – neither too hot (inflationary) nor too cold (in a recession).”

The National Bureau of Economic Research defines a recession (a hard landing) as a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.” A recession is accompanied by significant job losses.

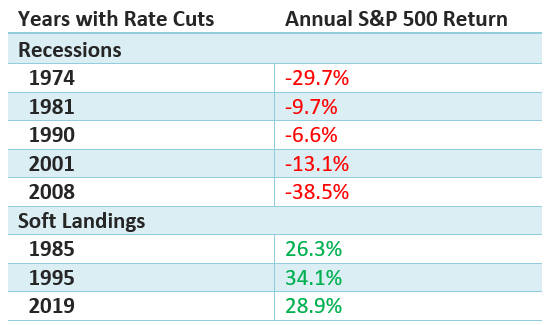

So then, how have stocks performed in the two scenarios?

Rate cuts during the soft-landing scenario have historically favored stocks. Not so when the Fed responds to a recession by reducing interest rates. Why? Because investors are more attuned to weak corporate earnings, not falling interest rates.

Rate cuts, soft landings, recessions, market returns.

Source: Macrotrends, St. Louis Federal Reserve, Annual S&P 500 return does not include reinvested dividends. The S&P 500 Index is an unmanaged index and cannot be invested into directly. Past Performance is no guarantee of future results.

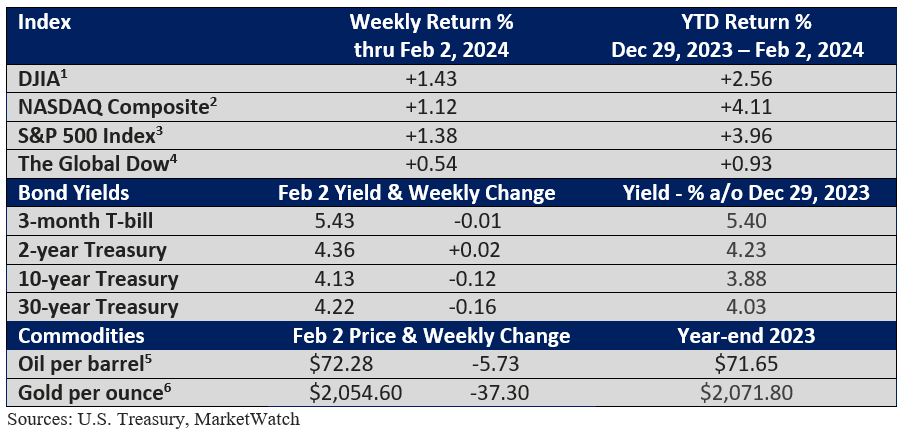

Market Summary

Please do not hesitate to contact me with any questions or concerns. I hope you have a wonderful week!

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

This information should not be construed as investment, tax, or legal advice. This commentary reflects the personal opinions, viewpoints, and analyses of the Stordahl Capital Management, Inc. employees providing such comments and should not be regarded as a description of advisory services provided by Stordahl Capital Management, Inc. or performance returns of any Stordahl Capital Management Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data, or any recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.