The Week in Review: January 27, 2025

Housing’s Worst Year in Nearly 30 Years

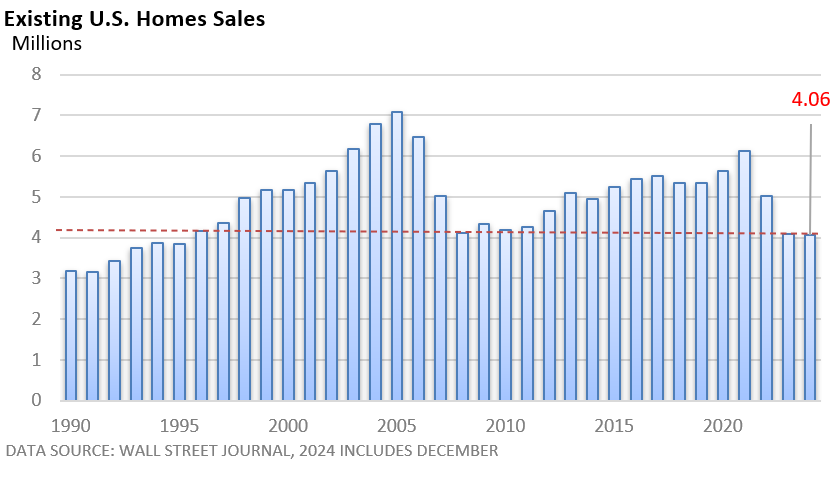

It is not much of a stretch to say that home sales are in the basement. In 2024, the annual number of existing homes sold fell slightly to 4.06 million, the lowest since 1995.

It’s important to note that 2024 came in lower than we observed during the height of the financial crisis in 2008 and 2009. Contrary to conventional wisdom, home prices have remained high despite the substantial decline in sales.

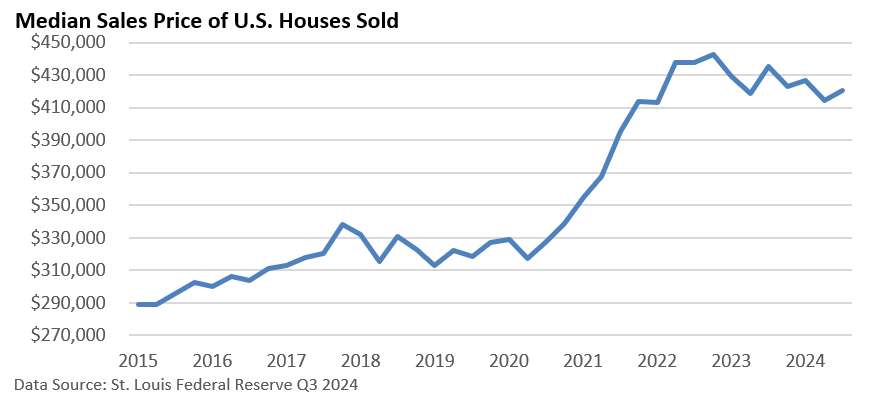

According to price data from the St. Louis Federal Reserve, the median price of a home sold in the third quarter of 2024 was $420,400.

Despite the sharp decline in sales, Q3’s median price sold is down just 5% from the peak two years ago. It’s up sharply from the pre-pandemic price of $329,000 in Q1 2020.

According to the National Association of Realtors, it boils down to a scarcity of homes for sale.

In part, some homeowners who might like to sell are reluctant to give up a low mortgage rate obtained in 2020 or 2021, which restricts the number of homes for sale and props up prices.

Inventories of homes available will likely rise in the spring, but they are expected to remain historically low. Over time, however, prospective buyers may become accustomed to higher rates, while current homeowners may recognize that they can no longer wait for lower mortgage rates as their life circumstances evolve.

Market Summary

TWO FOR THE ROAD

In 2024, the Magnificent 7 accounted for 53.1% of the S&P 500’s total return, which means the 25.02% return would have been 11.75% without them. - S&P Global, January 3, 2025

Adjusted for inflation the median net worth of people ages 35 to 44 was $130,380 in 1989. In 2022, that number was slightly higher, at $135,000. Those under 35 are also doing better, with a net worth of $39,040 in 2022, compared with an inflation-adjusted $18,740 in 1989. - BusinessInsider, January 9, 2025

Please do not hesitate to contact me with any questions or concerns.

I hope you have a great week!

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.