The Week in Review: July 6, 2020

Another Blowout Jobs Report

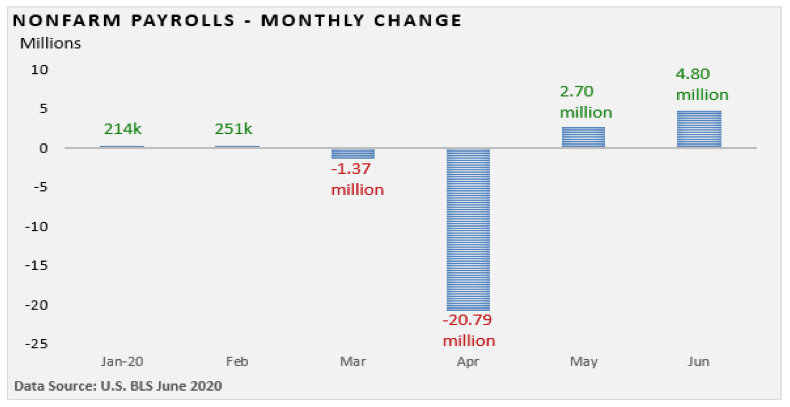

Nonfarm payrolls surged a record 4.8 million in June, which is on top of the 2.7 million increase in May per the U.S. Bureau of Labor Statistics. According to Econoday, the consensus forecast called for a rise of 3.0 million jobs. Meanwhile, the unemployment rate fell from 13.3% in May to 11.1% in June, beating the estimate of 12.4%.

While there is still plenty of ground to make up, the economy is progressing much faster than almost everyone had anticipated. Over the last two months, one-third of the jobs lost in March and April have come back.

Some of the increase is due to paycheck protection loans, but the reopening of businesses is probably the biggest reason for the record surge. If we delve into the data, the hard-hit sectors were responsible for a large share of the increase.

In joint testimony with U.S. Treasury Secretary Steven Mnuchin last week, Fed Chief Powell discussed the upturn in economic activity. “We have entered an important new phase and have done so sooner than expected,” he said. Still, he acknowledged the path forward is “extraordinarily uncertain and will depend in large part on our success in containing the virus.”

Mnuchin took a more optimistic tone.

He said, “The Blue Chip Report is forecasting that our GDP will grow by 17% annualized in the third quarter, and by 9% in the fourth quarter.” This follows what is expected to be a record contraction in Q2.

The recent jump in COVID cases may be cause for concern. Some states have put reopenings on hold, and others have backtracked as they try to control the spread of the virus.

If we review high-frequency data (daily/weekly economic reports), we are seeing an increase in travel through TSA checkpoints (as of July 1), while hotel occupancy continues to rise (Hotel News STR as of June 27).

Nonetheless, foot traffic to businesses, which had been in an upward trend, has edged downward (SafeGraph as of June 28). It bears watching.

The path forward is uncertain, and layoffs remain at a very high level. Despite the layoffs, the number of jobs still grew by almost 5 million in June.

The pandemic must be controlled if activity is to approach or exceed pre-COVID levels. Yet the surge in economic activity from very depressed levels is much better than nearly anyone could have hoped for just eight weeks ago.

You see it in employment growth, you see it in retail sales, and you see it in June’s jump in consumer confidence (Conference Board).

And while we can never rule out market volatility, we also see it in the sharp rise in stocks.

If you have any questions or concerns, feel free to reach out to me, Will or Tyler.

Two for the Road

The personal savings rate, in April, hit a historical record high of 33%. —Reuters, May 29, 2020

Nearly half of twitter messages agitating to “reopen America” are likely coming from bots. The tweeting appears to be aimed at sowing division and definitely matches the Russian and Chinese playbooks. —NPR, May 20, 2020

This commentary reflects the personal opinions, viewpoints and analyses of the Stordahl Capital Management, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by Stordahl Capital Management, Inc. or performance returns of any Stordahl Capital Management, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.