The Week in Review: June 12, 2023

A New Bull Market

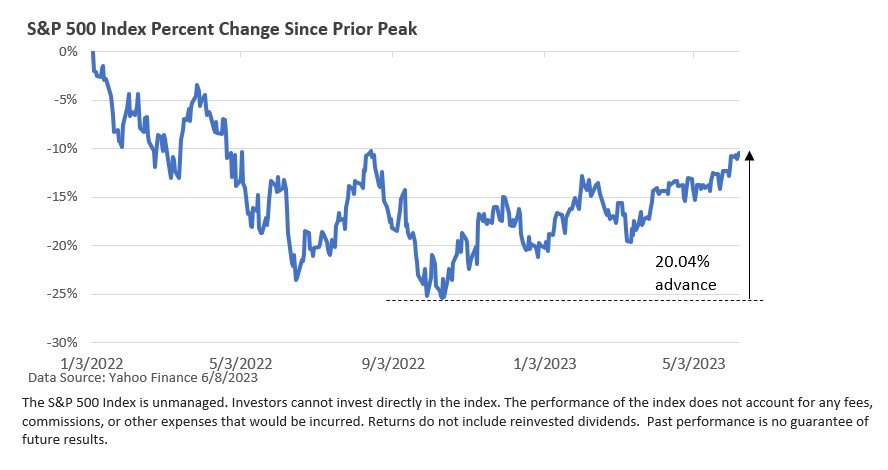

The S&P 500 Index, which tracks 500 large publicly traded companies, entered a new bull market last Thursday, according to the general definition of a 20% rise from the most recent low.

Let’s review some key mileposts. The index hit an all-time high of 4,797 on January 3, 2022. It proceeded to decline 25.4% to the most recent low of 3,577 on October 12th. A bear market is typically defined as a 20% or greater drop from the closing peak to the closing trough.

Since its most recent bottom, the index has rallied 20.04% to close at 4,294 on June 8th. Predicting short-term market fluctuations is nearly impossible, but the recent surge serves as a reminder that no one rings a bell when the market is about to rebound.

In order to eclipse the previous all-time high, the S&P 500 would need another 11.7% advance from June 8th’s close.

Climbing a wall of worry

There has been a multitude of concerns, including a much-advertised recession, persistent inflation, rising interest rates, regional bank failures, and the ongoing war in Ukraine.

But we’ve yet to slip into a recession, rate hikes have slowed significantly, and the banking crisis and war in Ukraine, which has caused immense human suffering, are off the front burner.

According to the Wall Street Journal and Barron's, the recent market rally has been unbalanced and primarily driven by a handful of giant tech companies. This trend is evident in the impressive growth of the Nasdaq Composite, while the Dow has lagged.

Although the Dow comprises only 30 major corporations, it currently serves as a more accurate reflection of the broader market.

What’s fueling the Nasdaq? A more gradual progression of rate hikes has helped. But a crucial factor that has propelled the triumph of several prominent tech companies is the soaring interest in businesses that aim to capitalize on artificial intelligence.

The laggards are running into resistance amid a still-high degree of economic uncertainty.

Two for the Road

Fund managers today have the lowest exposure to stocks relative to bonds since 2009.-The Wall Street Journal, May 14, 2023

In 1989, when adjusted for inflation, total family wealth in the U.S. was about $38 trillion. By 2022, that wealth had more than tripled, reaching $140 trillion. Of the $84 trillion projected to be passed down from older Americans to millennials and Gen X heirs through 2045, $16 trillion will be transferred within the next decade.-The New York Times, March 17, 2023

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.