The Week in Review: May 26, 2020

Climbing Out

The Q2 decline in economic activity will likely be the steepest ever. Currently, the biggest annualized contraction occurred in Q1 1958 (10%—St. Louis Federal Reserve) and was tied to the avian flu pandemic. Quarterly data reach back to 1947 per the U.S. Bureau of Economic Analysis (BEA).

Last week, the Congressional Budget Office forecast an eye-popping 38% annualized decline in Q2 gross domestic product (GDP). The Atlanta Fed’s GDPNow Model places growth at -41.9% as of May 19.

The huge range of forecasts in the Blue Chip consensus illustrates an enormous amount of uncertainty regarding the outlook. One thing is certain: Q2 will be ugly.

Looking ahead, it’s possible we may hit an economic bottom in May or June, as businesses gradually reopen.

What type of recovery might we see? We haven’t been through a pandemic of this magnitude in the modern era, and modeling such an event is difficult.

Georgia was one of the first states to reopen. In a CNBC interview last week, Atlanta Fed President Raphael Bostic said: “Some places and some people are feeling like they’re very prepared to jump back into the economy and get back to where they were pre-crisis.

“But there are a lot of businesses where they’re not seeing the same kind of foot traffic they were before.”

Injecting Cash into the Economy

One thing that is certain—an enormous amount of cash has been pumped into the economy via actions by the Federal Reserve and the federal government.

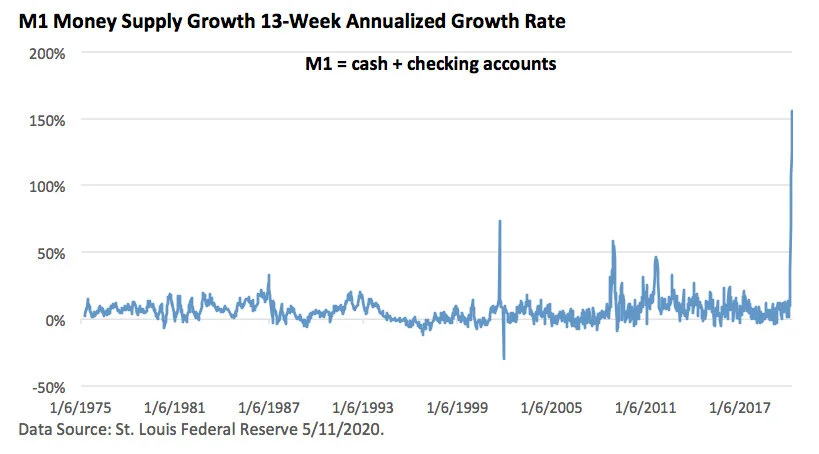

One measure of the money supply is called M1. It includes cash and checking accounts. Its growth rate has soared thanks to fiscal and monetary stimulus. It now exceeds $5 trillion.

The graphic below simply takes the 13-week change in the money supply and annualizes it.

Cash plus cash in checking accounts equals readily available cash that could be spent. Right now, however, the transmission mechanism is broken via lockdowns, closed businesses, and the fear to go out in public.

As lockdowns gradually end, will consumers feel comfortable spending and heading out in public? Some will, but others may continue to venture out sparingly.

Ultimately, much will depend on the path of the virus, the development of a vaccine, and the development of an effective treatment. If you have any questions or concerns, feel free to reach out to me, Will, or Tyler.

Two for the Road

At least 89 coronavirus vaccines are under development around the world, with seven now in human trials. Pfizer says that if its vaccine proves safe and effective, it might be available on a limited basis as early as September. The most quickly developed anti-viral vaccine to date was the one for mumps, licensed in 1967 after four years of research. —International Business Times, April 30, 2020

Online sales of pajamas surged 143% in April from March, while purchases of pants fell 13%. —CNBC, May 12, 2020

This commentary reflects the personal opinions, viewpoints and analyses of the Stordahl Capital Management, Inc. employees providing such comments, and should not be regarded as a description of advisory services provided by Stordahl Capital Management, Inc. or performance returns of any Stordahl Capital Management, Inc. Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.