The Week in Review: May 30, 2023

Fill ‘er Up

The days of pulling up to a gas station, rolling down the window, and asking the attendant to fill ‘er up are long gone. Nowadays, the responsibility falls on someone in the car to pump the gas.

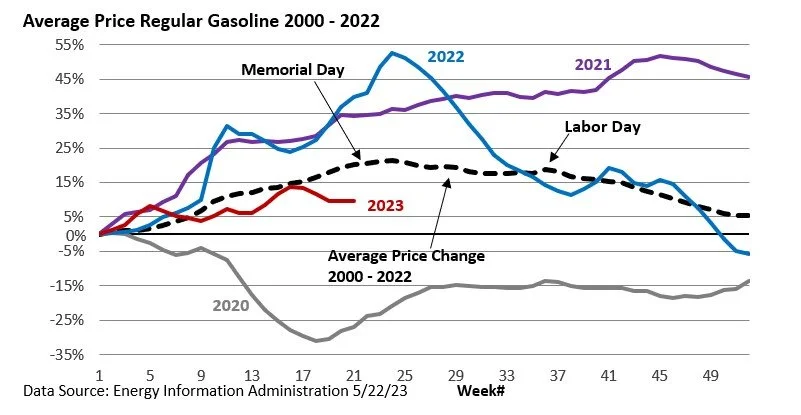

As we head into the summer season, it's no coincidence that the price of gasoline tends to increase, especially as we approach Memorial Day weekend.

From 2000 to 2022, the average cost of regular gasoline has increased by roughly 20% from the start of the year through Memorial Day.

However, it's important to note that gasoline prices vary significantly from year to year, with the cost typically dropping after Labor Day.

In 2020, the price of gas collapsed in response to the pandemic.

As demand recovered, prices jumped in 2021 and remained high into the fall. Markets were further destabilized by Russia’s invasion of Ukraine in 2022, leading to another sharp rise in energy costs.

This year’s economic uncertainty, which could hamper demand, has pressured prices heading into the holiday weekend. The rise in price this year is about half the longer-term average.

What’s behind the typical pattern? Retail gasoline prices tend to rise in the spring and peak in the summer when people drive more frequently. Gasoline specifications and formulations also change seasonally and fuel higher prices.

According to the Energy Information Administration (EIA), environmental regulations require that gasoline sold in the summer be less prone to evaporate during warm weather.

This requirement means that refiners must replace winter gasoline, which is more prone to evaporate, with less evaporative but more expensive components for summer usage.

From 2000 through 2022, the average monthly price of regular gasoline in August was about 39 cents per gallon higher than the average price in January, according to the EIA.

Although filling up in the summer is usually less budget-friendly, there are valid reasons for the rise in prices.

Two for the Road

Institutions have pulled a net $333.9 billion from stocks over the past 12 months, while individual investors have yanked another $28 billion. Analysts say extreme defensive positioning and high levels of cash mean market returns could snap back quickly from any selloff as investors seek to put cash back to work. - The Wall Street Journal, May 14, 2023

With Argentina’s inflation rate hitting 109%, the government is announcing emergency measures, including raising interest rates by 600 basis points to 97%. - Reuters, May 15, 2023

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.