The Week in Review: July 1, 2024

A Dysfunctional Housing Market

What happens when mortgage rates tumble below 3% and then spike above 7%? Unintended consequences are bound to play out. In hindsight, they aren’t difficult to spot.

You’re a winner if you have no intention of moving and were lucky enough to lock in ultra-cheap rates just a few years ago. Those who want to move or renters who want to buy are less fortunate.

Those who want to move feel trapped in their homes, as they are reluctant to trade in their cheap mortgage for a pricier one.

High rates were expected to lower housing prices, but that’s not happening.

A couple of weeks ago, the National Association of Realtors (NAR) reported that the median existing U.S. home price hit a record of $419,300 in May. That’s up from $266,300 in January 2020.

Eventually, some homeowners who need to move will put their homes on the market and trade their dirt-cheap mortgage for the prevailing rate.

Until then, according to the NAR, those who stay put are limiting the supply available. And that limited supply keeps prices high. It’s an unintended consequence of high rates—the opposite of what was anticipated when rates jumped.

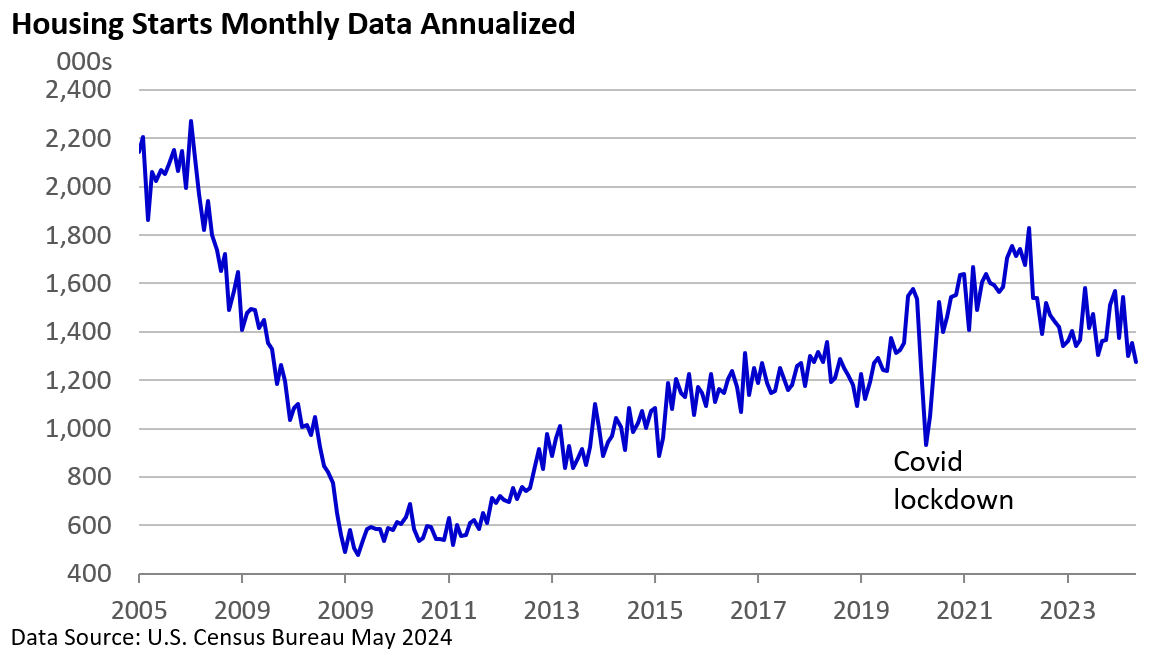

Yet, you might expect that a shortage of homes would spark a building boom.

It hasn’t.

Moreover, spending tied to real estate is down as fewer people renovate their homes before a sale. With sales down, fewer folks embark on projects after purchasing a home. And, of course, real estate agents, mortgage brokers, and others linked to the industry feel the pain.

So far, however, most of the pain has been limited to housing, as the economy has managed to shrug off the industry’s woes.

Market Summary

Two for the Road

According to the United States Patent and Trademark Office, $2 trillion worth of counterfeit products are sold globally each year, which is roughly equivalent to Canada's GDP. - MarketPlace, June 18, 2024

According to the Bureau of Labor Statistics, in 2022, the average person 65 years and older spent $4,818 a month. - Yahoo!Finance, June 20, 2024

Happy 4th of July! May you enjoy this day as you celebrate our independence and freedom with family and friends.

Bill Stordahl, CFP®

Managing Director

Stordahl Capital Management

Stordahl Capital Management, Inc is a Registered Investment Adviser. This commentary is solely for informational purposes and reflects the personal opinions, viewpoints, and analyses of Stordahl Capital Management, Inc. and should not be regarded as a description of advisory services or performance returns of any SCM Clients. The views reflected in the commentary are subject to change at any time without notice. Nothing in this piece constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Advisory services are only offered to clients or prospective clients where Stordahl Capital Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Stordahl Capital Management unless a client service agreement is in place. Stordahl Capital Management, Inc provides links for your convenience to websites produced by other providers or industry-related material. Accessing websites through links directs you away from our website. Stordahl Capital Management is not responsible for errors or omissions in the material on third-party websites and does not necessarily approve of or endorse the information provided. Users who gain access to third-party websites may be subject to the copyright and other restrictions on use imposed by those providers and assume responsibility and risk from the use of those websites. Please note that trading instructions through email, fax, or voicemail will not be taken. Your identity and timely retrieval of instructions cannot be guaranteed. Stordahl Capital Management, Inc. manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss. Past performance is no guarantee of future results.

1. The Dow Jones Industrials Average is an unmanaged index of 30 major companies which cannot be invested into directly. Past performance does not guarantee future results.

2. The NASDAQ Composite is an unmanaged index of companies which cannot be invested into directly. Past performance does not guarantee future results.

3. The S&P 500 Index is an unmanaged index of 500 larger companies which cannot be invested into directly. Past performance does not guarantee future results.

4. The Global Dow is an unmanaged index composed of stocks of 150 top companies. It cannot be invested into directly. Past performance does not guarantee future results.

5. CME Group front-month contract; Prices can and do vary; past performance does not guarantee future results.

6. CME Group continuous contract; Prices can and do vary; past performance does not guarantee future results.